Education costs have increased dramatically over the past decade. Whether you are a parent, grandparent, or family member helping to fund a child’s education, planning can make a meaningful difference. With the right approach, you can plan for more—more options, more confidence, and more opportunity for the student you’re supporting.

We can help you navigate the complexities of college planning with a personalized strategy designed to align with your family’s priorities, values, and long-term financial objectives.

We can work closely with you to create a comprehensive education funding plan tailored to your family’s goals and priorities. Our services include:

- Family College Planning Conversations: Help guide productive conversations about college costs and funding with you, your student, and extended family.

- College Cost Estimates: Estimate the cost of public and private colleges and project future expenses based on education inflation.

- Savings Goals and Strategy: Set clear college savings goals and determine how much you should be saving over time.

- Education Savings Options: Identify the right savings options based on your income, tax situation, and how much control you want over the assets.

- Portfolio Coordination: Review your investments to help ensure college costs don’t interfere with your other financial goals.

- Paying for College: Evaluate ways to pay for college, including 529 plans, UGMA/UTMA accounts, retirement assets, and other investments.

- Financial Aid and Loans: Provide guidance on financial aid, student loans, insurance considerations, and related planning decisions.

- Student Money Basics: Help college-bound students build budgeting skills and a foundation for smart financial habits.

Tax-Advantaged Education Savings Options

Depending on your goals and circumstances, education savings may include:

- Uniform Gifts to Minors/Uniform Transfers to Minors Accounts (UGMA/UTMA)

- 529 College Savings Plan

- Coverdell Education Savings Account

Janney Financial Planning

Through Janney’s comprehensive financial planning process, we can help you determine whether you’re on track—and what adjustments may be needed—to meet your education savings goals. Together, we address key questions such as:

- Which assets should be used to fund education for one or multiple students?

- What are the expected costs of the schools you’re considering?

- How much should you save to cover part or all of those costs?

- Are you saving enough today to stay on track?

- Which accounts are best suited for college savings, and how are they taxed?

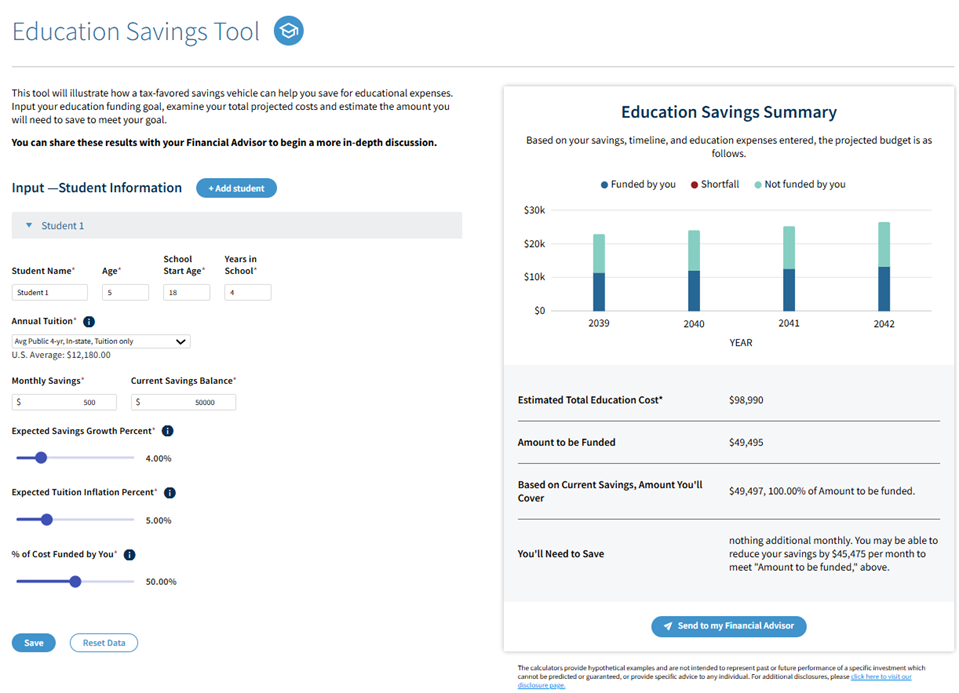

Janney Education Savings Tool

Available through Online Access, our Education Savings tool helps you see where you stand and how to move forward. You can:

- Input your college funding goals

- View total projected education costs

- Estimate the monthly savings needed to reach your objective

- Receive personalized insights to help you plan with confidence

Start Planning Today

Whether you’re just beginning to save or want to check in on your progress, we’re here to help you plan for more—for your child’s education and your financial future. Let’s talk about your college savings and investing needs and create a strategy that supports both today’s priorities and tomorrow’s possibilities.

Contact us to get started.